To ensure that SatoshiPay is truly a global payment system for digital publishers on the borderless web, it is necessary to provide an easy way for our publishers to comply with VAT/sales tax in all jurisdictions in the world. Therefore, we have rolled out a system that simplifies the tax compliance by reselling the digital content of our publishers to the consumer.

Overview

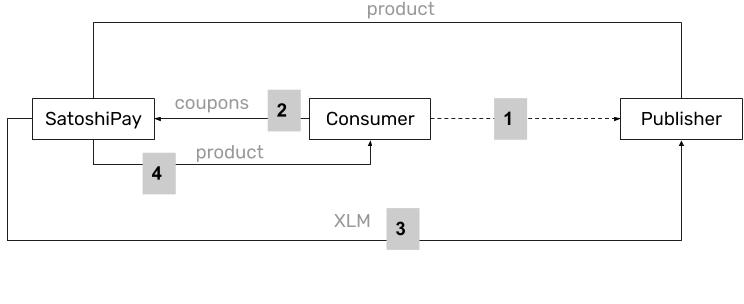

From a legal point of view, the system works like this:

- Consumer initiates a purchase on publisher’s website

- Consumer transfers pre-paid coupons to SatoshiPay

- SatoshiPay buys the product from publisher with XLM. This is a B2B transaction — i.e. tax can be claimed back.

- SatoshiPay delivers the product to consumer, although in practical terms the publisher is delivering the actual content from their server. This is the fulfilment of a B2C sale — i.e. tax must be applied. SatoshiPay deducts the relevant amount during the payment process and arranges with the settlement of tax obligation with the relevant authorities.

The amount of VAT/sales tax depends on the location of the publisher and the consumer. For example, if both publisher and consumer are located in the same country, the tax deducted would most likely be different than if they were in two different states with no cross-border tax agreement at the national level.

Comments

0 comments

Article is closed for comments.